Inflation Bites

Inflation is the one form of taxation that can be imposed without legislation

Milton Friedman

Most people have nostalgia for their youth. Being a kid. High school.

Me, I’m rather fond of 2019.

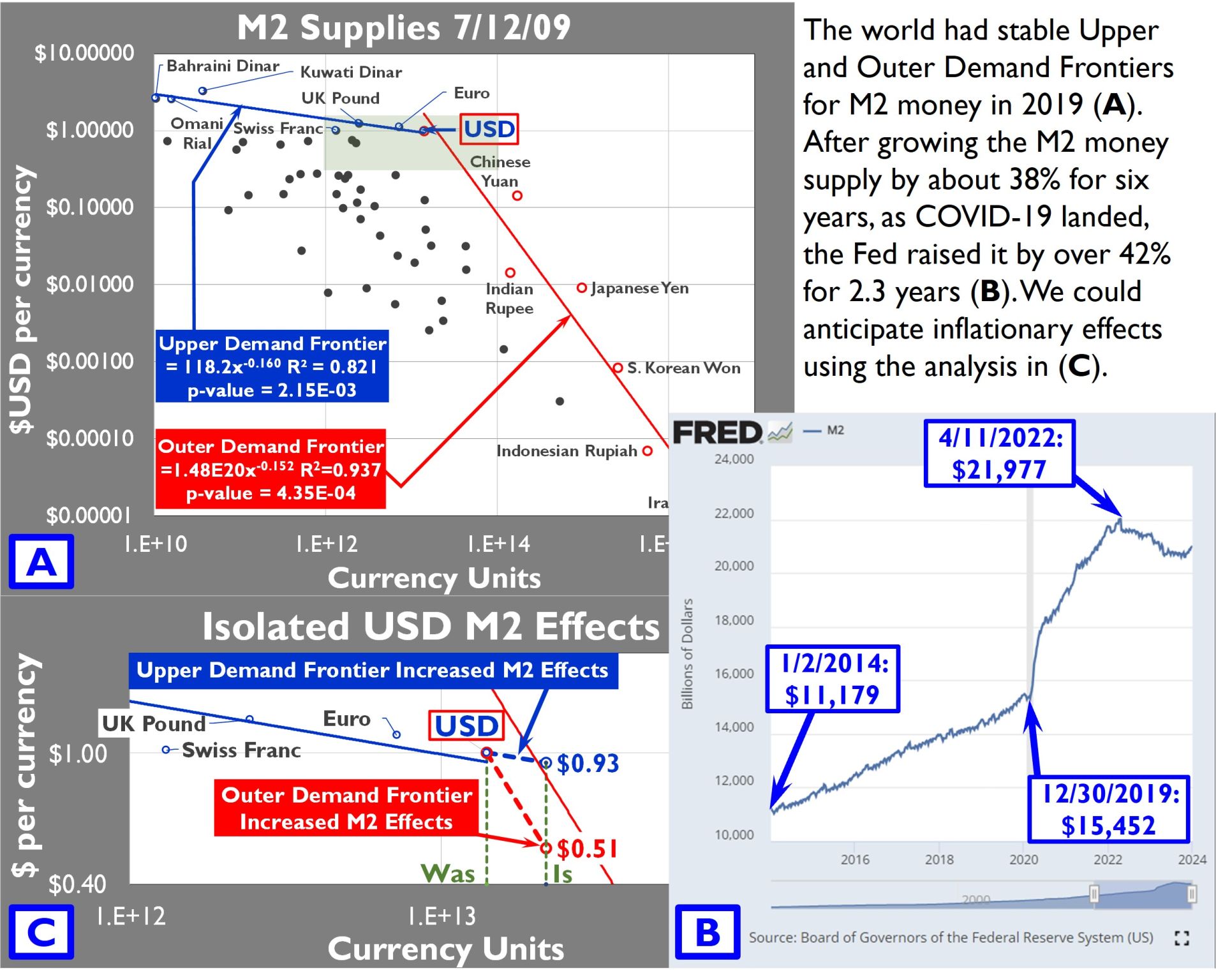

As shown in (A), those halcyon pre-COVID-19 days found government currencies stable. The United States Dollar (USD), The World’s Reserve Currency, found its appropriate resting spot at the vertex of the Outer Demand Frontier while resting squarely on the Upper Demand Frontier simultaneously. As shown in (B), for the six years before 2020, M2 grew slowly (< 1% annually) and predictably.

USG initiatives to keep the economy moving started with COVID-19 and continued for over two years, during which the Fed swelled the growth rate of M2 to nearly 17% annually. We can predict the primary effects of that action on USD in (C). There, a 55% instant increase in M2 drops the value of USD to $0.93 along the Upper Frontier and to $0.51 on the Lower Frontier.

While these movements occurred over time and in relation to other countries’ money supplies, we still feel those effects today.

The amount of currency is a primary determinant of its value. Reserve banks will be well-advised to examine the Demand for their currency before issuing vast amounts more.

#inflation #hypernomics